The program, enacted as part of the Tax Cuts and Jobs Act, was created to help spur economic activity by investment in low-income neighborhoods in exchange for deferred capital gains. The incentive creates qualified opportunity funds (QOFs), which are partnerships or corporations formed specifically to invest in QOZs. Due to other tax reform matters commanding the headlines, this part of the bill largely flew under the radar. The following answers several common questions about the new tax incentive.

Who?

Anyone with a capital gain is eligible to participate. The capital gain can come from any type of property including public stocks, mutual funds, private businesses, or real estate.

QOFs that accept third-party investors may be subject to accredited investor rules, meaning there are minimum requirements for net worth ($1 million) or income ($300K married, $200K individual). However, there are mass marketed products that do not have such requirements.

Where?

There are eligible opportunity zones in all 50 states. In early 2018, states nominated up to 25% of the low-income census tracts within the state. The IRS released a bulletin certifying the full list of QOZs, which can be found on this interactive map.

What?

A QOF is an entity that either invests in tangible property (typically real estate or a development project) within a QOZ directly or invests indirectly through an equity interest in a subsidiary. For a QOF to qualify under IRS rules, effectively all of the property has to be within a designated opportunity zone. Alternatively, a QOF can own an interest in a corporation or partnership, and the investment will qualify if the underlying entity derives 50% or more of its gross income from an active business in a QOZ. The business also cannot be a “sin business,” such as a liquor store, casino, etc.

The QOZ property must be acquired after December 31, 2017. If an existing property, the fund must substantially improve the property by at least the purchase price (the initial basis) within 30 months following the acquisition. The “property” does not have to be real estate necessarily and could be a business interest.

How are capital gains and deferrals treated?

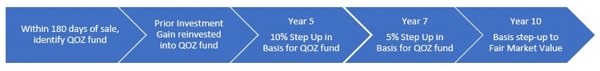

An investor can reinvest the capital gains on a property sale to defer and/or reduce those capital gains taxes. The first step is to identity a QOZ fund to invest in within 180 days of the sale of the property. The initial tax basis in the qualifying investment is zero. After the investment is held for five years, the tax basis in the original investment is increased by 10% of the deferred gain. After the investment is held for seven years, the tax basis increases an additional 5% to a total of 15%. Investors must recognize gain by the earlier of when the QOF is sold or December 31, 2026, on the original 85% of capital gains. After ten years, investors permanently avoid any capital gains tax on the post-acquisition gains as it steps up to fair market value. There is no limit on the amount of gain that can be used.

Bottom Line

There are literally trillions of dollars of capital gains eligible to participate. Deferring capital gains with potentially minimal taxes owed is a game changer. This is truly something new that creates wins for communities, developers, and investors. Nonetheless, investors must be vigilant considering the risks of any QOF and how it fits into the construction of an investment portfolio. Questions?

Questions about this article?

Contact Paul Etzler, CPA, CGMA, GACP, at 440-449-6800 or email Paul. You may also reach Michael McKeown, CFA, CPA, at 440-605-1900 or email Michael.

at 440-449-6800 or email Paul. You may also reach Michael McKeown, CFA, CPA, at 440-605-1900 or email Michael.

Guest Article by Skoda Minotti

Important Information Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Aurum Wealth Management Group, LLC-“Aurum”), or any non-investment related content, made reference to directly or indirectly in this tweet will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this tweet serves as the receipt of, or as a substitute for, personalized investment advice from Aurum. Please remember that if you are an Aurum client, it remains your responsibility to advise Aurum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Aurum is neither a law firm nor a certified public accounting firm and no portion of the tweet content should be construed as legal or accounting advice. A copy of Aurum’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please note that Aurum does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Aurum’s web site or tweet or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Posts by Tag

- Sustainability (173)

- sustainability consulting (146)

- Energy Efficiency (129)

- Utilities (94)

- LEED (88)

- Sustainable Design (69)

- green building certification (60)

- energy audit (48)

- ESG (46)

- construction (43)

- GHG Emissions (37)

- WELL (32)

- carbon neutrality (32)

- tax incentives (28)

- costs (27)

- net zero (27)

- energy modeling (20)

- electric vehicles (17)

- Energy Star (14)

- Housing (14)

- Inflation Reduction Act (13)

- water efficiency (13)

- Social Equity (12)

- decarbonization (12)

- diversity (10)

- NGBS (7)

- fitwel (7)

- Earth Day (6)

- Engineering (6)

- electrification (5)

- mass timber (5)

- non-profit (5)

- retro-commissioning (5)

- Emerald Gives (4)

- News Releases (4)

- B Corp (3)

- COVID-19 Certification (3)

- Customers (3)

- EcoVadis (3)

- Indoor Air Quality (3)

- PACE (3)

- Arc (2)

- DEI (2)

- EcoDistricts (2)

- Green Globes (2)

- cannabis (2)

- CDP (1)

- SITES (1)

- furniture (1)

- opportunity zone (1)

- womenleaders (1)