It is widely accepted that to avoid total environmental collapse, human-generated greenhouse gas emissions need to reach Net Zero no later than 2050. Carbon accounting will play a crucial role in these decarbonization efforts across the corporate value chain. Over 90% of companies listed on the S&P 500 and 70% on the Russell 1000 published sustainability reports in 2020, and this number has been climbing annually. However, compliance alone is no longer the main driver for sustainable business strategies.

The triple bottom line of people, planet, and profit goes beyond regulatory mandates and creates an opportunity for corporations to lead instead of follow. Additionally, the range of benefits associated with high environmental, social, and governance (ESG) ratings continues to grow, from better risk management to improved long-term financial success. As a result, voluntary ESG reporting is on the rise, and carbon accounting frameworks are a core mechanism to demonstrate impact reduction.

In the race towards globally mandated net-zero goals, the right carbon accounting system will be vital in making informed decisions for effective corporate sustainability strategies. However, the carbon accounting process remains relatively opaque, with no single internationally accepted methodology.

To help you navigate this process, we've broken down the leading carbon accounting protocols and their key differences.

Why Pursue Carbon Accounting

Understanding how many emissions a business produces and where they come from is the first step in any decarbonization strategy. Additionally, the most widely accepted ESG reporting frameworks require an accurate count of your emissions.

Today, innovative carbon accounting systems are no longer a one-size-fits-all calculation. Instead, they are built to be sector-specific and use different methodologies depending on scope. There are many reasons to pursue a carbon accounting protocol within an ESG framework, such as:

- Tax incentives related to decarbonization efforts

- Messaging of sustainable values

- Builds trust through transparency with stakeholders and consumers

- Displays good governance to investors

- Cultivates a healthy corporate culture and attracts talent

- Reduces future risk by being ahead of mandates

- Studies reveal long-term financial benefits of voluntary ESG reporting

Above all, transparency and accountability are good business practices that display a purpose beyond profit.

Protocols For Carbon Accounting

Greenhouse Gas Protocol (GHG Protocol)

Developed in 1997, the Greenhouse Gas Protocol is a joint initiative between the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD). It was developed following the Paris Climate Agreement to help countries and businesses pursue emissions goals to keep the global temperature rise below 1.5 degrees Celsius.

Since then, the GHG protocol Corporate Accounting and Reporting Standard has become the world's most widely used greenhouse gas accounting standard. It provides various resources, including calculation tools, guidance, and verification services.

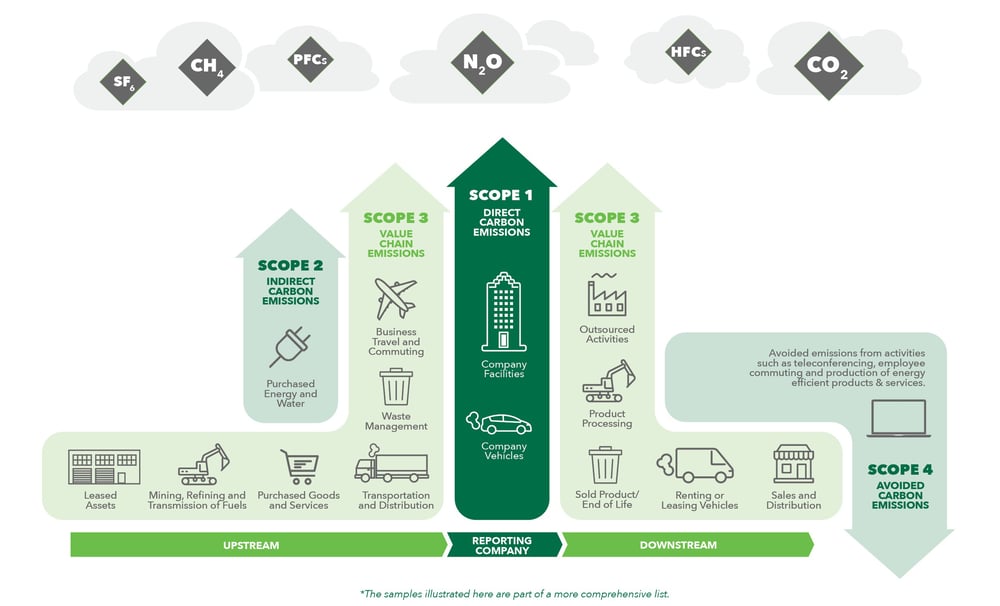

The hallmark of the GHG Protocol is a three-scope method of tracking emissions, with the sum being the total carbon footprint.

- Scope 1: Direct emissions, including those created from production and transportation equipment.

- Scope 2: Indirect emissions from energy purchased or generated.

- Scope 3: All other indirect emissions (value chain emissions), usually from the supply chain, including a company's customers and end-use consumers.

The same three scopes that define the GHG Protocol are also considered one of its weaknesses. While most companies using this protocol include Scopes 1 and 2, some do not include Scope 3.

This is likely because Scope 3 requires information from suppliers and customers throughout the value chain, which is challenging to calculate. However, for many companies, Scope 3 emissions will represent the most significant part of a company's carbon footprint.

Who Uses the GHG Protocol: Companies, cities, and governments use this carbon accounting protocol. Over 90% of Fortune 500 companies use the GHG Protocol directly or indirectly.

The Task Force on Climate-Related Financial Disclosures (TCFD)

The TCFD was created by the Financial Stability Board (FSB) to improve market transparency by recommending what carbon emissions financial companies should measure and how to report them. Founded in 2017, the TCFD is structured around four themes: governance, strategy, risk management, and metrics and targets.

Unlike the GHG Protocol, which solely focuses on carbon accounting, the TCFD includes 11 disclosures to provide transparency to carbon reporting.

The goal of TCFD is to harmonize greenhouse gas accounting methods within the financial industry to allow financial organizations to consistently measure their emissions and support investors in weighing risks related to climate change.

However, there are some complaints regarding this framework. One of the most prevalent is company directors citing increased liability arising from the uncertainty associated with forecasted carbon emissions – one of the key criteria of the TCFD.

Who Uses the TCFD Protocol: Financial markets (investors, lenders, and insurance underwriters) use the TCFD Protocol as part of ESG reporting and carbon accounting. The main regions that use TCFD include the European Union, Singapore, Canada, Japan, Hong Kong, New Zealand, and the United Kingdom.

The Partnership for Carbon Accounting Financials (PCAF)

Created by Dutch banks in 2015, PCAF measures financed emissions, helping to align financial institutions with net zero goals. Building on the GHG accounting methodologies developed by GHG Protocol, they aim to create a consistent global GHG accounting standard for financial institutions covering various assets.

These asset classes include:

- Listed Equity and Corporate Bonds

- Business Loans and Unlisted Equity

- Project Finance

- Commercial Real Estate

- Mortgages

- Motor Vehicle Loans

The PCAF is complementary to the TCFD and provides a framework for financial institutions to disclose their greenhouse gas emissions. It does not provide its own carbon accounting tools and conforms with the GHG Protocol.

Who Uses PCAF: The PCAF Standard is being implemented in five regions: Africa, Asia-Pacific, Europe, Latin America, and North America. It covers financial institutions and financial products of all sizes.

Corporate Sustainability Means Leaning into Carbon Accounting

To bring it all together, we refer to the International Sustainability Standards Board (ISSB), which is responsible for the development of a universal set of sustainability reporting standards operating under the International Financial Reporting Standards (IFRS) Foundation. Adopted in 2023, with go-forward applicability effective January 1, 2024, IFRS S1 and S2 require entities to disclose material sustainability-related financial information. The focus of IFRS S2 is on the disclosure of climate-related risks and opportunities that could be reasonably expected to affect cash flows, access to finance, or the cost of capital over short-, medium-, and long-term thus intertwining sustainability disclosure with corporate valuation.

Through consolidation as opposed to integration in 2023, the IFRS Foundation absorbed The Climate Disclosure Standards Board and the Value Reporting Foundation (comprised of the SASB Foundation and the International Integrated Reporting Council). It also signed cooperation agreements with CDP and GRI, while aligning its standard with the GHG Protocol as well as the TCFD and TNFD Frameworks. These agreements unify the alphabet soup of sustainability standards, bring clarity to preparers and users of material sustainability information, and ultimately strengthen the development of sustainability disclosure, in many ways mirroring its role in the development of financial disclosure. Despite IFRS S1 and S2 being established less than a year ago, the existing global structure of the IFRS Foundation and its close ties to capital market regulators are expediting the incorporation of IFRS S1 and S2 into regulatory frameworks around the world, including entry onto the recommended list of future considerations by the SEC.

Understanding the available carbon accounting and emissions reporting frameworks is critical in measuring your emissions and developing a sustainability plan. While it is still voluntary to report on business sustainability, investors, stakeholders, and governments are beginning to expect it. We would not be surprised if sustainability reporting becomes a requirement in the not-so-distant future – the SEC has pending regulations calling for it.

A carbon accounting protocol and robust sustainability strategy help companies be proactive and prepare for regulatory change. Additionally, there is a large list of financial and social benefits for ESG-conscious businesses. If you want to capitalize on these benefits, let us know! We have the tools in place to help you develop a robust sustainability strategy and choose an effective carbon accounting framework for your business.

Posts by Tag

- Sustainability (173)

- sustainability consulting (146)

- Energy Efficiency (129)

- Utilities (93)

- LEED (88)

- Sustainable Design (69)

- green building certification (60)

- energy audit (48)

- ESG (46)

- construction (43)

- GHG Emissions (37)

- WELL (32)

- carbon neutrality (32)

- tax incentives (28)

- net zero (27)

- costs (26)

- energy modeling (19)

- electric vehicles (17)

- Energy Star (14)

- Housing (14)

- Inflation Reduction Act (13)

- water efficiency (13)

- Social Equity (12)

- decarbonization (12)

- diversity (10)

- NGBS (7)

- fitwel (7)

- Earth Day (6)

- Engineering (5)

- electrification (5)

- mass timber (5)

- non-profit (5)

- retro-commissioning (5)

- Emerald Gives (4)

- News Releases (4)

- B Corp (3)

- COVID-19 Certification (3)

- Customers (3)

- EcoVadis (3)

- Indoor Air Quality (3)

- PACE (3)

- Arc (2)

- DEI (2)

- EcoDistricts (2)

- Green Globes (2)

- cannabis (2)

- CDP (1)

- SITES (1)

- furniture (1)

- opportunity zone (1)

- womenleaders (1)